If you want to manage your personal finances, the first habit you have to start is saving money. It doesn’t matter whether you are a beginner in financial planning or you are a person who has been trying to save money for a long time, this guide gives you detailed practical, actionable tips to help you save money from your salary. Let’s start with how to secure your financial future while making the most of your earnings.

Table of Contents

To save money from your salary following are the step by step guidence :

1. Set Clear Financial Goals

When you are saving, you have to have a clear vision of how much you are saving or what expenses you are incurring. You have to create a clear mindset in your mind about this thing. Break your financial goals separately, such as short-term, medium-term and long-term objectives. Following are the examples:

- Short-term goals: Emergency fund, vacation, or buying a gadget.

- Medium-term goals: Down payment for a house or higher education.

- Long-term goals: Retirement planning or children’s education.

When you have a purpose behind save money from your salary, it becomes easier to stay disciplined and motivated.

2. Create a Budget

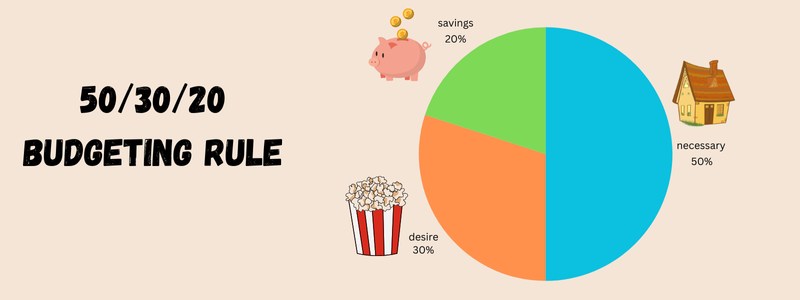

When it comes to saving, budgeting has the key role for effective money management, you have to budget in a better way, where and how much money you will allocate to your salary. You should follow the 50/30/20 rules as follows:

- 50% for necessary: Rent, utilities, groceries, and transportation.

- 30% for desired spending: Entertainment, dining out, and hobbies.

- 20% for savings and investments.

You can use budgeting apps like YNAB, Mint, or even a simple Excel sheet to track your income and expenses.

3. Automate Your Savings

One of the most effective ways to save money from your salary is by automating the process, wherein you can instruct the bank to transfer a fixed percentage of your salary to some savings account or some investment fund every month. This will be beneficial for you because just as you will get your salary, your savings part from your salary has already been set aside before you spend unnecessary from your salary.

4. Build an Emergency Fund

An emergency fund acts as a financial cushion, you never know when something may happen, there can always be an unexpected situation such as job loss, medical emergency or any other major problem, so you need to be prepared for every situation. You should aim to have at least 5-6 months of living expenses with you at all times. Keep maintaining an emergency fund in liquid and easily accessible form, like a high-yield savings account.

5. Cut Unnecessary Expenses

Do a proper audit of your expenses every month and analyze where you spend or what expenses you can control without compromising your quality of life. Consider the following.:

- Cancel unused subscriptions: Streaming services, gym memberships, or apps you rarely use.

- Limit dining out: Cook meals at home to save significantly.

- Shop smart: Wait for sales, use cashback apps, and avoid impulsive purchases.

6. Track Your Expenses

It is very important to track the expenses where you are spending your money so that you will have a proper idea about where and how much you are spending. Use apps like Expense Manager, spendee, etc to record your daily expenditures. If you regularly review your spending then you will be able to analyse your spending habits which will help you in identifying where you are incurring unnecessary expenditure.

7. Invest Wisely

If you just save money from your salary, this isn’t enough and won’t help you grow your money, it is very important to invest your money in a safe place, so that your money grows over time. Consider these investment options:

- Mutual Funds: Systematic Investment Plans (SIPs) allow you to invest small amounts regularly.

- Stocks: For those with a higher risk tolerance.

- Fixed Deposits (FDs): For guaranteed returns with minimal risk.

- Public Provident Fund (PPF): A government-backed scheme offering tax-free returns.

- National Pension Scheme (NPS): Ideal for long-term retirement planning.

If you have no idea about investment, it is always advisable to consult a financial advisor.

8. Avoid Lifestyle Inflation

As your income increases, you do not have to suddenly upgrade your lifestyle, instead of spending your money on luxury items or services, direct the additional income towards your savings or investments.

9. Pay Off Debt

High-interest debts, such as credit card balances and personal loans, can erode your savings. Prioritize clearing these debts as quickly as possible using strategies like the debt snowball method (paying off smaller debts first) or the debt avalanche method (focusing on high-interest debts).

10. Leverage Employee Benefits

Many companies offer benefits that can help you save money, such as:

- Health insurance: Reduces your medical expenses.

- Provident fund contributions: A portion of your salary is automatically saved for retirement.

- Meal coupons or allowances: Can be used to reduce your food expenses.

Make sure you’re taking full advantage of these perks.

11. Practice Delayed Gratification

Avoid impulsive purchases, often impulsive buying turns out to be the wrong decision, you wait for a few days before you buy something(except the necessary thing). A few days’ cooling period will make you realize whether the thing you were about to purchase was truly necessary to you or not.

12. Save on Taxes

Take advantage of tax-saving options to reduce your taxable income:

- Section 80C: Invest in ELSS funds, PPF, or tax-saving fixed deposits.

- Health insurance premiums: Deductible under Section 80D.

- Home loan interest: Deductible under Section 24(b).

Consult a tax advisor to optimize your savings.

13. Embrace Minimalism

Living a minimalist lifestyle doesn’t mean depriving yourself but focusing on what truly adds value to your life. Spend on experiences rather than material possessions and declutter to save on storage and maintenance costs.

14. Start Side Hustles

If your salary alone isn’t sufficient to meet your financial goals, consider starting a side hustle. Freelancing, blogging, or tutoring can provide additional income that can go directly into savings

15. Review and Adjust Regularly

Your financial situation and goals will evolve over time. Periodically review your budget, savings, and investments to ensure they align with your current priorities. Make adjustments as needed to stay on track.

Final Thoughts

let’s summarize all the points mentioned above if you want to save money from your salary then you require proper discipline, planning, and a proactive approach in order to manage your finances. By following the tips outlined in this guide you can build a solid foundation for financial security. and achieve your goals. You must always remember that the journey to financial freedom begins with small, consistent steps. So best wishes to you, start today and watch your savings grow.